How to Get Grants for College

College grants are a form of financial aid that does not have to be repaid. They are awarded based on financial need and/or academic merit, and they can help students cover the cost of tuition, fees, books, and living expenses.

There are many different types of college grants available, each with its own set of eligibility requirements. Some of the most common types of grants include:

- Federal Pell Grants

- State Grants

- Institutional Grants

- Private Scholarships

The search intent of the keyword “how to get grants for college” is to find information on how to apply for and receive financial aid in the form of grants for college. People who search for this keyword are likely interested in learning more about the different types of grants available, the eligibility requirements, and the application process. They may also be looking for tips on how to improve their chances of getting approved for a grant.

To learn more about the different types of grants available, the eligibility requirements, and the application process, visit the following websites:

| Feature | Answer |

|---|---|

| College Grants | A college grant is a type of financial aid that does not need to be repaid. Grants are awarded based on financial need or merit, and they can help students cover the cost of tuition, fees, books, and other expenses. |

| Financial Aid | Financial aid is money that helps students pay for college. There are many different types of financial aid available, including grants, scholarships, loans, and work-study programs. |

| Scholarships | A scholarship is a type of financial aid that is awarded based on academic achievement, extracurricular activities, or other criteria. Scholarships do not need to be repaid. |

| Apply for College | The application process for college can be complex, but it is important to start early. The first step is to research colleges and universities that you are interested in. Once you have a list of colleges, you can start the application process. |

| Financial Aid for College | There are many different types of financial aid available for college students. The most common types of financial aid include grants, scholarships, loans, and work-study programs. |

II. Types of Financial Aid

There are many different types of financial aid available to college students, including grants, scholarships, loans, and work-study programs. Each type of aid has its own set of eligibility requirements and benefits, so it’s important to understand the different options before you start applying for financial aid.

Here is a brief overview of the different types of financial aid:

- Grants are financial aid awards that do not need to be repaid. Grants are often based on financial need, but some may also be awarded based on merit or other factors.

- Scholarships are similar to grants in that they do not need to be repaid, but they are typically awarded based on merit or achievement. Scholarships can be sponsored by organizations, businesses, or individuals.

- Loans are financial aid awards that must be repaid. Loans can be subsidized or unsubsidized. Subsidized loans do not accrue interest while the student is enrolled in school, but unsubsidized loans do.

- Work-study programs allow students to earn money to help pay for college expenses. Work-study jobs are typically on-campus, but some may be off-campus.

It’s important to note that not all students will qualify for all types of financial aid. The amount of financial aid you receive will depend on your financial need, your academic achievements, and the availability of aid from different sources.

If you’re interested in learning more about the different types of financial aid available, you can visit the U.S. Department of Education’s website at studentaid.gov.

III. FAFSA and Other Financial Aid Applications

The FAFSA is the Free Application for Federal Student Aid, and it is the most important financial aid application you will fill out. The FAFSA is used to determine your eligibility for federal student aid, including grants, loans, and work-study. The FAFSA is also used by some state and college financial aid programs.

The FAFSA is available to students who are US citizens or permanent residents, and who are enrolled or planning to enroll in a degree or certificate program at an accredited college or university.

The FAFSA is due on January 1, 2023. However, you should submit your FAFSA as early as possible, as some financial aid programs have limited funds and are awarded on a first-come, first-served basis.

You can complete the FAFSA online at fafsa.gov.

In addition to the FAFSA, you may also need to complete other financial aid applications, such as the CSS Profile or the college’s own financial aid application.

The CSS Profile is a financial aid application used by some private colleges and universities. The CSS Profile is more comprehensive than the FAFSA, and it asks for more information about your family’s finances.

The college’s own financial aid application is used by some colleges and universities to supplement the FAFSA. The college’s financial aid application may ask for information about your academic record, your extracurricular activities, and your personal statement.

You can find out more about the FAFSA, the CSS Profile, and the college’s own financial aid application by visiting the financial aid office at your college or university.

How to Get Grants for College

There are a number of ways to get grants for college, including federal grants, state grants, and private grants. Federal grants are offered by the U.S. government, state grants are offered by state governments, and private grants are offered by private organizations.

The amount of money you can receive in grants will depend on your financial need and the type of grant you apply for. Federal grants are typically need-based, while state and private grants may be need-based or merit-based.

To apply for federal grants, you must fill out the Free Application for Federal Student Aid (FAFSA). The FAFSA is available online at fafsa.gov.

To apply for state and private grants, you will need to contact the specific organization that is offering the grant.

Here are some tips for getting grants for college:

- Start your research early. The application deadlines for many grants are in the fall, so it’s important to start your research early so you have plenty of time to apply.

- Complete the FAFSA as early as possible. The FAFSA is used to determine your eligibility for federal grants, as well as other forms of financial aid. The sooner you complete the FAFSA, the sooner you will be able to find out if you are eligible for any grants.

- Be specific about your goals. When you are applying for grants, it is important to be specific about your academic and career goals. This will help the grantor determine if you are a good fit for their grant.

- Highlight your accomplishments. When you are writing your grant application, be sure to highlight your accomplishments. This could include your academic achievements, your extracurricular activities, or your work experience.

- Proofread your application carefully. Before you submit your grant application, be sure to proofread it carefully for any errors. This will help you make a good impression on the grantor and increase your chances of being approved.

By following these tips, you can increase your chances of getting grants for college. Grants can help you pay for college and reduce your student debt, so it’s worth taking the time to research and apply for them.

V. How to Apply for Financial Aid

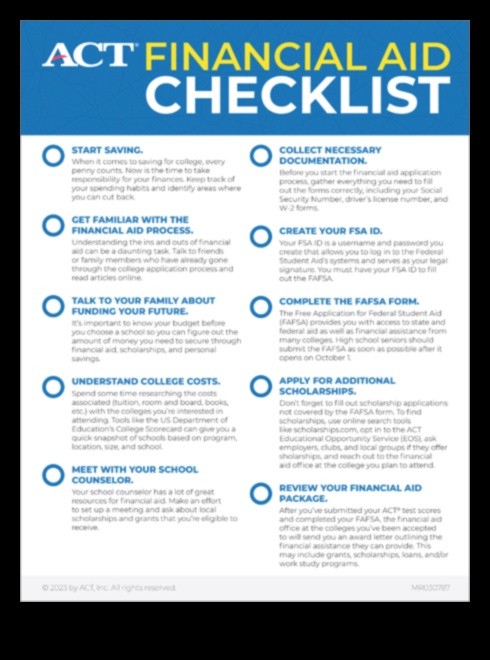

The financial aid application process can be complex, but it is important to complete all of the necessary steps in order to maximize your chances of receiving financial aid. The following tips can help you through the process:

- Start early. The financial aid application process can take several months, so it is important to start early.

- Gather all of the necessary documents. You will need to provide proof of your income, assets, and expenses.

- Complete the FAFSA. The FAFSA is the Free Application for Federal Student Aid, and it is the first step in the financial aid process.

- File your taxes. You will need to file your taxes in order to receive federal financial aid.

- Apply for scholarships and grants. There are many scholarships and grants available, so be sure to apply for as many as you qualify for.

- Meet with your financial aid advisor. Your financial aid advisor can help you through the process and answer any questions you may have.

By following these tips, you can increase your chances of receiving financial aid to help you pay for college.

How to Get Grants for College

There are a number of ways to get grants for college, including federal grants, state grants, and private grants. Federal grants are offered by the U.S. Department of Education, and state grants are offered by state governments. Private grants are offered by foundations, corporations, and other organizations.

To qualify for a grant, you must meet certain eligibility criteria, such as being a U.S. citizen or permanent resident, having a certain GPA, and demonstrating financial need. The amount of the grant you receive will depend on your financial need and the availability of funds.

The following are some tips for getting grants for college:

- Start your research early. The application deadlines for many grants are in the fall, so it’s important to start your research early so you have plenty of time to apply.

- Complete the FAFSA. The FAFSA is the Free Application for Federal Student Aid, and it’s the first step in applying for federal grants.

- Research state and private grants. In addition to federal grants, there are also a number of state and private grants available. Be sure to research all of your options to find the best grants for you.

- Write strong grant essays. Many grants require you to write an essay as part of your application. Be sure to take your time writing your essay and make sure it’s well-written and persuasive.

- Apply for multiple grants. The more grants you apply for, the better your chances of getting one.

Getting grants for college can help you pay for your education and reduce your student loan debt. By following these tips, you can increase your chances of getting the grants you need to pay for college.

VII. Financial Aid for College Students with Disabilities

College students with disabilities may be eligible for a variety of financial aid programs, including grants, scholarships, and loans. These programs can help students cover the cost of tuition, fees, books, and living expenses.

To be eligible for financial aid for college students with disabilities, you must meet the following criteria:

- You must be a U.S. citizen or permanent resident.

- You must be enrolled in a degree-seeking program at an accredited college or university.

- You must have a documented disability that impairs your ability to participate in school activities.

If you meet these criteria, you can apply for financial aid through the Free Application for Federal Student Aid (FAFSA). The FAFSA is a form that you submit to the U.S. Department of Education to determine your eligibility for federal financial aid programs.

In addition to federal financial aid programs, there are also a number of state and private financial aid programs available for college students with disabilities. You can find more information about these programs on the websites of your state’s higher education agency and the National Center for College Students with Disabilities.

Financial aid can help college students with disabilities cover the cost of college and achieve their educational goals. If you have a disability, be sure to apply for financial aid to help you pay for school.

Financial Aid for College Students with Children

If you are a college student with children, you may be eligible for financial aid to help pay for the costs of college. There are a number of different types of financial aid available to college students with children, including grants, scholarships, loans, and work-study programs.

The amount of financial aid you are eligible for will depend on your family’s income and assets, the number of children you have, and your educational expenses. You can find more information about financial aid for college students with children on the U.S. Department of Education’s website.

Here are some tips for applying for financial aid if you are a college student with children:

- Start early. The financial aid application process can take time, so it’s important to start early. The FAFSA opens on October 1st each year, and the priority deadline for most colleges and universities is February 1st.

- Complete the FAFSA. The FAFSA is the Free Application for Federal Student Aid, and it is the first step in applying for financial aid. You can complete the FAFSA online at fafsa.ed.gov.

- Submit your tax returns. You will need to submit your most recent tax returns to complete the FAFSA. If you are not required to file taxes, you can still submit a tax return transcript.

- Gather your financial information. You will need to gather your financial information, such as your income, assets, and expenses, to complete the FAFSA.

- Apply for scholarships and grants. In addition to federal financial aid, you may also be eligible for scholarships and grants from private organizations. You can find more information about scholarships and grants on the College Board website.

- Consider taking out a loan. If you do not qualify for enough financial aid to cover the cost of college, you may need to take out a loan. There are a variety of different types of student loans available, so be sure to do your research before you decide which loan to take out.

- Work-study programs. Work-study programs allow you to earn money to help pay for college. You can find work-study jobs on your college campus or in the community.

If you are a college student with children, there are a number of resources available to help you pay for college. By taking advantage of these resources, you can make your dream of a college education a reality.

IX. Financial Aid for College Students from Low-Income Families

College is a great investment, but it can be expensive. If you’re a low-income student, there are a number of financial aid options available to help you pay for college.

Some of the most common financial aid options for low-income students include:

- Federal Pell Grants

- Federal Supplemental Educational Opportunity Grants (SEOG)

- State grants and scholarships

- Private scholarships and grants

- Work-study programs

- Loans

To learn more about financial aid for low-income students, visit the following websites:

In addition to these resources, you can also talk to your high school guidance counselor or financial aid office for more information about financial aid options for low-income students.

FAQ

Q: What is a grant?

A: A grant is a type of financial aid that does not have to be repaid. Grants are awarded based on financial need or merit, and they can be used to cover a variety of college expenses, such as tuition, fees, books, and living expenses.

Q: What are the different types of grants available?

A: There are a variety of different types of grants available, including federal grants, state grants, and private grants. Federal grants are awarded by the U.S. Department of Education, and they are based on financial need. State grants are awarded by state governments, and they may be based on financial need or merit. Private grants are awarded by private organizations, and they may be based on financial need, merit, or other factors.

Q: How do I apply for a grant?

A: The application process for grants varies depending on the type of grant you are applying for. However, most grants require you to submit a FAFSA form, which is the Free Application for Federal Student Aid. You may also need to submit other documents, such as proof of your financial need or academic achievements.